Hey, everybody!

How are you all? I trust fall is similarly as warm and radiant in your place all things considered in my old neighborhood. I can’t sit at home and I take every last risk to head outside. Today I went out to shop with my best pal. She was really shopping (and got herself a Magnificent woolen sweater that feels SO Delicate, I just can’t), while I was simply “window shopping.” truly, I’ve nearly wound up in a tight spot financially because my folks gave me during the current month.

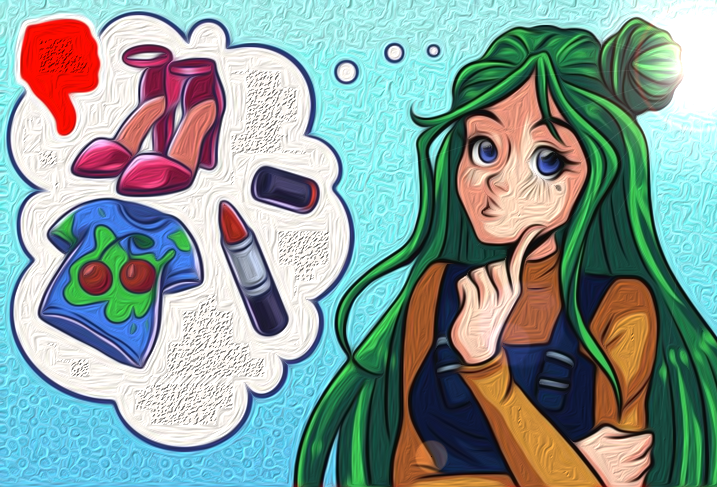

Last week, I chose to do some web-based shopping since I really wanted another knapsack and athletic shoes for my exercises. I went to my number one web-based store and afterward, it worked out… I saw Ravishing extravagant shoes in a cherry variety that I once saw on my number one entertainer when she was strolling the honorary pathway. The shoes were expensive, however, I pondered internally, “Hello! You have sufficient means to purchase them!” And I did. And afterward, I purchased lipstick in a coordinating shade and a Shirt with certain cherries on it (I don’t have the foggiest idea why). The point when I understood I spent practically the entirety of my financial plan in like 10 minutes, it was past the point of no return… “Much thanks to you for your request!” and the bundle is headed to my home… It resembled a fantasy, and presently I really want to extend a couple of dollars that are left in my pocket for a very long time in some way or another…

So I understood I expected to change my way to deal with planning and spending, and I perused the Web searching for some planning tips for young people. I realize that setting aside cash annoys numerous teenagers, so I chose to share the monetary tips I found with you. They are right here!

Prior to shopping, make a rundown of the things you really want to purchase, instead of the things you Need. For instance, consider purchasing sports shoes you really want for your exercises pretty much consistently as opposed to purchasing extravagant shoes you’ll just wear two or multiple times (don’t rehash my mix-ups).

- Do all necessary investigations prior to purchasing something. Ensure you can’t buy exactly the same thing at a lower cost elsewhere and read clients’ surveys.

- Utilize your understudy ID without limit. In certain spots, an understudy ID permits youngsters to shop within limits. See whether it works in your city!

- Begin gathering coupons. It might seem like something grown-ups with many children could ordinarily do, however, who said youngsters can’t utilize coupons? It’s tomfoolery and it can save you a considerable amount of cash!

- Aside from coupons, there are some other advertising apparatuses that organizations use to attract more clients, and you can really take advantage of them as well. For instance, a few organizations offer limits to new clients, streak deals that mainly last a restricted measure of time, occasion or occasional deals, or week-after-week limits for specific merchandise. Simply ensure you DON’T Succumb to brilliant publicizing and purchase Just THE THINGS YOU Want.

- Consider purchasing utilized things rather than new ones when it’s fitting.

- Visit secondhand shops. Here, you can track down numerous beneficial things at low costs (or in any event, For nothing!).

- Begin a bank account. This will get you far from circumstances where you have no cash and can assist you with having a good sense of safety. Check in the event that your bank has reserve funds offers for youngsters. Request that your folks assist you with tracking down all the fundamental data.

- Try not to spend the cash you put into your investment account without really thinking. This is a secret stash!

- Utilize an application that computes your costs. This will assist you with dissecting your buys and purchasing just what’s essential.

- Besides the fact that you stretch can your spending plan, you can likewise attempt to bring in some cash. This can be as seasonal work or a late spring position, yet you want to ensure that your folks concur and that teen business is legitimate where you reside.

I’ve proactively begun utilizing these tips, and I genuinely want to believe that they can assist you with extending your financial plan (or even lifting it) as well.

Folks, do you examine your financial plan and costs? Or on the other hand, would you say you are spending instinctively? We should talk in the remarks!